Updated 15:13 IST, September 3rd 2024

7-Eleven owner faces an inconvenient value truth

A new owner would probably focus on narrowing that gap, and happily offload other businesses to do so.

No benefit of doubt. An unsolicited takeover has boosted Seven & i shares by nearly one quarter despite neither it nor the bidder, Canada's Alimentation Couche-Tard, revealing an offer price. It's the clearest sign yet of a deep lack of confidence in CEO Ryuichi Isaka's ability to unlock the full value of the Japanese company. New owners have a better shot at helping the conglomerate to reach its potential.

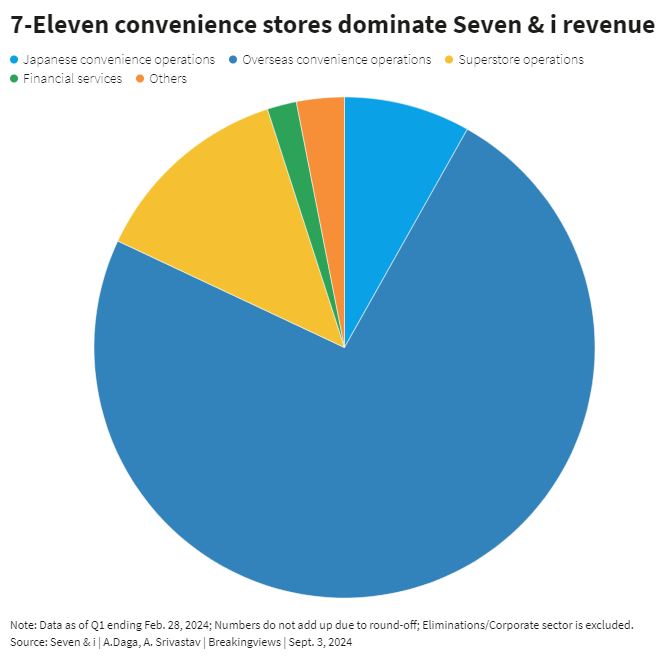

Seven & i encompasses restaurants, Ito-Yokado superstores, a listed financial services firm, a record shop, and a Shiitake mushroom producer. It is best known, though, for its 7-Eleven convenience stores. The company’s Japanese outlets are world-class and highly profitable, but the big opportunity is improving its stores overseas which bring in three quarters of the company's revenue.

Isaka's attempts at replicating 7-Eleven's model outside Japan have so far been disappointing. The company's overseas convenience stores generated a 4% EBITDA margin in the three months ended May 2024, compared to 38% in Japan. That’s partly because many outlets in North America, where Seven & i operates some 13,000 stores following its acquisition of Speedway in 2021, sell low-margin gasoline. However, Couche-Tard’s overall business has margins that are twice as wide.

A new owner would probably focus on narrowing that gap, and happily offload other businesses to do so. Although 7-Eleven in Japan benefits from food products developed by the company's superstores, those synergies may be less important in other countries where customers have different tastes.

Assume the overseas convenience store enterprise is valued at nearly 11 times expected EBITDA, the average multiple of a basket of four peers including Couche-Tard and U.S. rival Casey's General Stores. Using Visible Alpha forecasts for February 2025, it would be worth $46 billion. The Japanese business, which is more profitable but has lower growth, might justify a multiple of eight times, the upper end of a range JPMorgan analysts assign to the unit. That would be $19 billion.

Those two units alone are worth more than 60% above where Seven & i's entire enterprise was trading before Couche-Tard's offer and 40% more than its implied worth following the post-bid bump in its share price. In a full break-up scenario Seven & i's equity might be worth as much as 3500 yen per share, double its undisturbed price, Breakingviews calculates.

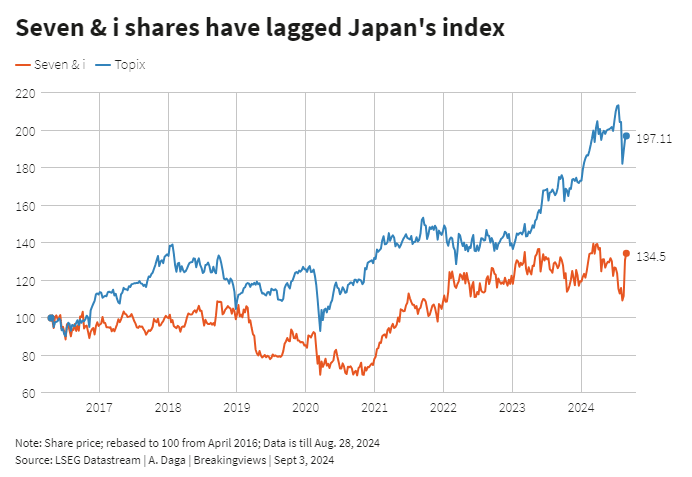

Isaka could in theory deliver some of that value to shareholders himself. But his track record is a problem. Seven & I shares have underperformed Japan’s benchmark Topix Index by some 60 percentage points since he took charge of the iconic company eight years ago, and the stock has continued to lag since independent directors occupied a majority of board seats in 2022. As such, his promises to create value will carry less weight than an offer that Couche-Tard or another bidder can dangle.

Context News

Shares of Japan's Seven & i have risen 23% since Aug 16, the last trading day before it said on Aug 19 that it had received a preliminary takeover proposal from Canada's Alimentation Couche-Tard. The target company said its board of directors has formed a special committee to study the proposal, the firm's stand-alone plans and other alternatives. Couche-Tard said it had submitted a friendly, non-binding proposal and was focused on reaching a mutually agreeable deal.

Published 15:13 IST, September 3rd 2024