Published 14:19 IST, September 21st 2024

Mercedes’ China motor hits one of two roadblocks

The Maybach maker derives over a third of its car sales from the Middle Kingdom, while Bernstein analysts reckon the country’s share of total operating profit

- Opinion

- 3 min read

Making amends. Mercedes-Benz’s all-important China motor is sputtering. The $64 billion luxury carmaker warned of collapsing earnings and free cash flow this year, as a real estate bust in the People’s Republic means less demand for upmarket rides. A deteriorating political backdrop suggests the worst may not yet be over.

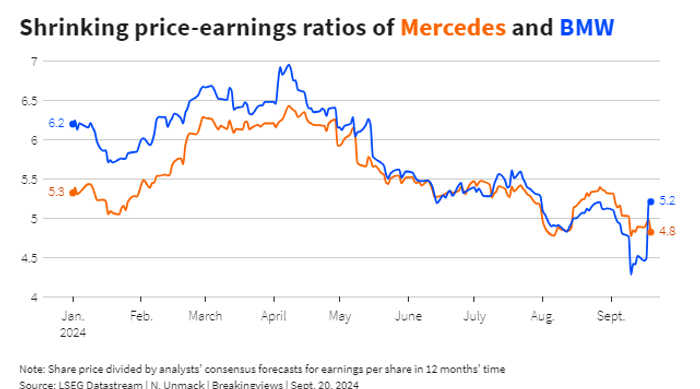

Mercedes’ profit warning on Thursday night managed to be both unsurprising and shocking at the same time. The Maybach maker derives over a third of its car sales from the Middle Kingdom, while Bernstein analysts reckon the country’s share of total operating profit stood at 37% last year. Yet Chinese sales are hurting from a property-market slowdown and a vicious price war in electric vehicles. Rival BMW had already warned on profit earlier this month.

Still, the magnitude of the cut that Mercedes CEO Ola Källenius announced was unexpected. Having promised a 2024 operating margin of 10% to 11% in its automotive unit as recently as July, Källenius now expects a margin of 7.5% to 8.5%, with the ratio in the second half of the year as low as 6%. Back in 2022, the equivalent figure was 15%.

Like many carmakers, who are grappling with competition and the shift to electric vehicles, Mercedes has been keeping investors happy by returning capital, with buybacks and dividends of around 12 billion euros planned this year. Yet 2024 free cash flow may be just 8.5 billion euros now, analysts reckon, potentially affording less room for buybacks next year. Alternatively, Källenius could keep the capital-return party going by selling some of his 35% stake in 26-billion-euro Daimler Truck, which the parent group spun off in 2021.

The good news for investors is that Mercedes’ stock could be cheap if China bounces back. Assuming that the bottom line recovers next year to where the carmaker had previously expected it to be, at 11.5 billion euros, the group would be trading on less than 5 times forward earnings after Friday’s roughly 7% fall. That compares with a long-term average of around 7, using LSEG data.

Yet there’s little hope of a real estate revival in China. And the competition in electric vehicles and combustion-engine cars in the Middle Kingdom may even increase as growth slows and the country’s ageing demographics kick in. Citigroup analysts estimate that Mercedes is selling electric vehicles in China at a 37% discount to the recommended retail price, up from 18% last September. Moreover, if the European Union goes ahead with plans to slap import levies on Chinese EVs, then the higher-end cars that Mercedes ships to China, like the Maybach, could suffer from counter-tariffs. The road ahead looks treacherous.

Updated 14:19 IST, September 21st 2024