Published 15:14 IST, October 30th 2023

Need a personal loan? Don't miss these warning signs

To protect borrowers from becoming targets of loan scams, experts emphasise the significance of identifying red flags and implementing prudent precautions.

- Money

- 3 min read

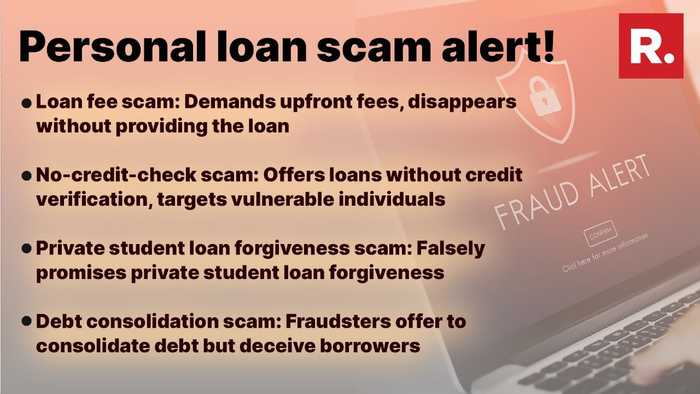

As consumers seek financial assistance, the threat of personal loan scams continues to grow. With fraudulent practices leading to huge losses, the need for vigilance and awareness is more critical than ever. To safeguard borrowers from falling victim to loan scams, experts stress the importance of recognising warning signs and adopting cautious measures.

Tips to detect personal loan scam

Guarantees of approval

Reputable lenders assess borrowers' credit worthiness before granting loans, taking into account payment history and financial responsibility. Watch out for lenders promising approval without any credit checks, as they often target vulnerable individuals and charge excessive fees.

Unregistered lenders

Verifying the legitimacy of lenders is paramount. Check if the lender is registered with the Federal Trade Commission in your state, as unregistered lenders might lack the authority to issue loans and could be potential scammers.

Upfront payments

Legitimate lenders may charge application fees, but they deduct these from the loan amount. Be cautious of lenders demanding upfront payments via prepaid cards or gift cards, as such transactions are untraceable and might indicate fraudulent intentions.

Unsolicited contact

Exercise caution when lenders initiate contact through unsolicited phone calls, mail, or door-to-door solicitations. Reputable lenders rely on traditional online and mass media advertising, avoiding high-pressure tactics to obtain personal information.

Lack of physical address

Verify the lender's physical address through reliable sources like Google Maps. Any absence of a valid physical address could be a potential red flag for fraudulent practices.

High-pressure tactics

Beware of lenders creating an artificial sense of urgency to force quick decisions. Reputable lenders provide sufficient time for borrowers to consider loan offers without resorting to undue pressure.

Unsecured websites

Prioritise your online security. Only provide personal information on secure websites with the "https" prefix and a padlock icon, as unsecured sites pose significant risks of data theft and fraud.

Too good to be true

Stay cautious of loan offers that seem too good to be true, like guaranteed approval or unrealistically low interest rates. Reputable lenders conduct comprehensive assessments and avoid making deceptive promises.

Who is at risk?

Fraudsters frequently focus on individuals experiencing financial difficulties.

"Scammers often target individuals facing financial hardships, the elderly, and those with bad credit. Vulnerable borrowers seeking quick loans are particularly susceptible," said Arpit Suri, CA and personal finance expert. "Confirming state registration, conducting credit checks, and verifying physical addresses are vital steps to determine lenders' legitimacy," he added.

Steps to take if scammed

- Gather documentation- Collect evidence like emails or screenshots to support your case.

- Contact law enforcement- File a police report to establish an official record.

- Inform oversight agencies- Reach out to the state attorney general's office, the FBI, the FTC, and the Better Business Bureau to protect others from similar scams.

- Raise awareness- Share your experience with family and friends to help them avoid falling victim to scams.

- Place a fraud alert- Notify a major credit bureau to safeguard your credit from potential fraud attempts.

Updated 14:59 IST, December 25th 2023