Published 15:20 IST, July 3rd 2024

The risk of a euro crisis is rising

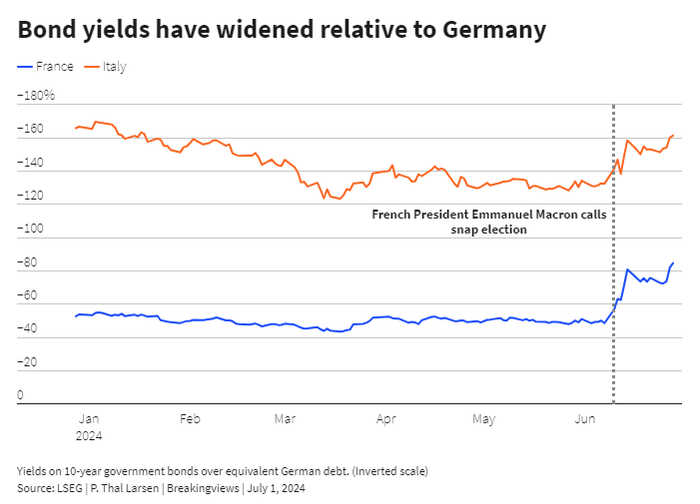

Since President Emmanuel Macron called the election, the difference between yields on French and German 10-year government bonds has widened.

Advertisement

Crisis, what crisis?. One way of looking at the euro zone is as a forest where dry tinder is piling up. The locals are not doing much to clear the debris, and some are wandering around with naked flames. But they know it would be foolish to throw lit matches on the forest floor. Besides, there is a fire engine which will probably ride to the rescue.

In other words, the risks of a new crisis in the single currency area, like the meltdown it suffered over a decade ago, are rising. But the conditions are probably not ripe to trigger one yet.

Advertisement

The main current fear is that France, where the far-right Rassemblement National (National Rally) dominated the first round of snap parliamentary elections, may enter a period of extreme political instability and fiscal profligacy. This could lead to a sharp rise in yields on French government bonds.

Other highly indebted euro zone members, especially Italy, could suffer contagion. The single currency would then be on the ropes. France and Italy are much bigger economies than Greece and the other euro zone members which were at the centre of the last crisis.

Advertisement

But this scenario does not seem imminent because Jordan Bardella, the far-right candidate for prime minister, has been toning down his party’s fiscal promises. The National Rally has its eye on winning the French presidential election in 2027 and would be foolish to undermine its credibility by provoking a financial crisis before then.

Investors are not very perturbed. Since President Emmanuel Macron called the election, the difference between yields on French and German 10-year government bonds has widened from 49 basis points to 85 basis points. The contagion to Italy has been limited: the yield spread on its bonds relative to German bunds has risen to 162 basis points, from 133 basis points. Back in 2011, when Silvio Berlusconi was prime minister, the gap reached 560 basis points.

Advertisement

That said, the medium-term outlook for the single currency is worrying. High debts, pressing spending needs and low growth in many countries at a time of rising nationalism and geopolitical conflict are storing up trouble.

Lines of defence

Advertisement

The euro zone has ways to protect itself against a financial crisis. If the spreads on a country’s bond yields widen sharply, the European Central Bank could step in and buy its debt. Its Transmission Protection Instrument (TPI) is designed to “counter unwarranted, disorderly market dynamics”.

The central bank is much more willing to intervene than it was at the start of the last euro crisis. It was only after Mario Draghi became its president and promised to do “whatever it takes” in 2012 that the ECB developed a tool to fight market mayhem.

The central bank would probably throw its mantle of protection around any well-behaved country which suffered a sharp increase in bond spreads. Even then, the TPI is not a blank cheque. The ECB says it will only ride to the rescue if a country pursues “sound and sustainable fiscal and macroeconomic policies”. So a delinquent government could be left to face debt investors on its own, as Greece was until it adopted a responsible fiscal programme in 2015.

Debt maths

What’s more, one difference with the euro crisis is that interest rates are now higher. It is therefore more costly to service government debts.

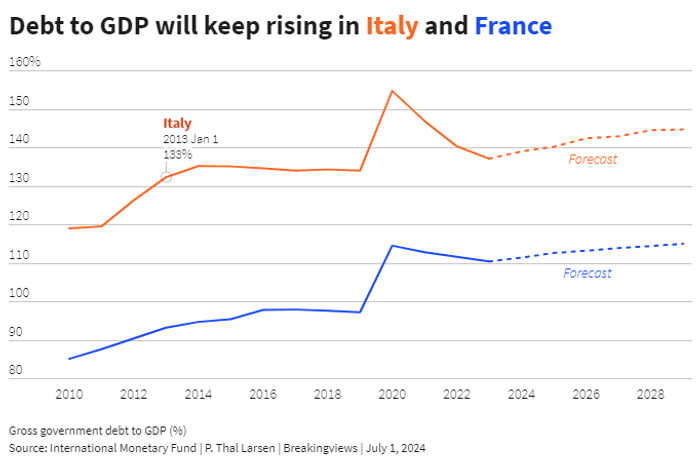

Italy’s borrowing was 137% of national income last year while French debt was at 111%, according to the International Monetary Fund. Meanwhile, the two countries’ fiscal deficits were 7.2% and 5.5% of GDP, respectively.

The European Commission, the EU’s executive arm, last month concluded that both countries – along with another seven which use the single currency and three that do not – have excessive deficits. In the coming months it will seek to persuade each to cut its debt ratio as part of the union’s Excessive Deficit Procedure. France and Italy may have to tighten fiscal policy by 0.5% and 0.6% of GDP respectively if they get the maximum seven years to adjust, according to Bruegel, the think tank.

Politicians will not want to cut public spending or raise taxes as this will undermine their popularity and dampen economic growth. But they may well negotiate a deal with the Commission. If so, markets should stay calm for now.

The problem is that debt ratios are currently forecast to keep rising, reaching 145% of GDP for Italy and 115% for France by 2029, according to the IMF. So borrowing ratios will still stay high even after some fiscal trimming.

It will also be hard to keep deficits down. All European governments will need to spend more money on defence, climate change and ageing populations in coming years. If Russia defeats Ukraine, countries are likely to engage in panic spending on arms.

Euro zone countries will not just be able to grow out of their debts either. The French economy will expand at an average rate of just 1.3% over the next six years, while Italy will manage only 0.6%, according to the IMF.

Their task will get even tougher if the geopolitical situation deteriorates. A creeping cold war between China and the United States, and the resulting fragmentation of the global trading system, is already restraining the world economy. If Donald Trump returns to the White House and carries out his promises to impose tariffs, growth will take another knock.

The EU could counter some of these forces if it could boost productivity and investment. It could reinforce its single market, which currently does not include energy, capital markets and digital communications. It could adopt a targeted EU-wide industrial policy, funded by a central budget, to make sure it does not fall behind China and the United States, which are using subsidies to support their companies.

Draghi will soon be producing a blueprint along these lines. The problem is that these policies require greater unity. The nationalist politicians on the rise throughout the EU will be reluctant to adopt them. The euro zone therefore seems condemned to slow growth and high debt. As more dry tinder accumulates on the forest floor, the risk of another blaze keeps growing.

15:20 IST, July 3rd 2024