Published 14:37 IST, November 19th 2024

Stock Market Live: Sensex Surges 1,000 Pts, Nifty up 1.29%

Stock Markets Today: Stay updated with the latest live news and insights from the Indian stock markets! Get real-time updates on Sensex, Nifty, top gainers, top losers, and more.

Advertisement

- Listen to this article

14:36 IST, November 19th 2024

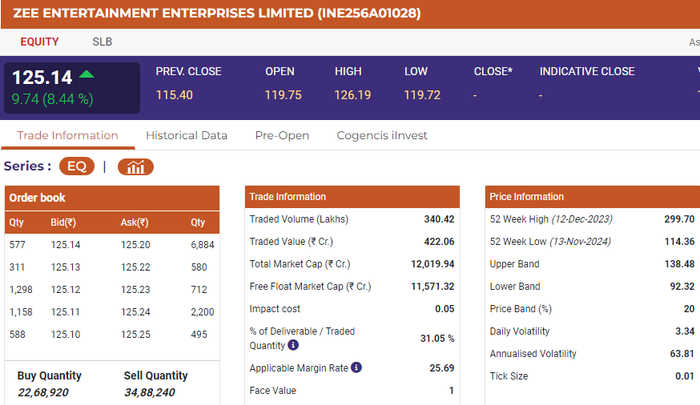

M&M Leads Sensex With Nearly 5% Gains

Source: NSE

13:52 IST, November 19th 2024

Bounce from Oversold Zones: Ajay Bagga on Market Recovery

Ajay Bagga observed, “Positive global cues and a heavily oversold market are seeing a 1 per cent to 1.5 per cent bounce in the Indian markets today. The causes of the downtrend in Indian stocks are still very much present...FPI selling (though at a reducing intensity), downgrades to corporate earnings, slower economic growth and high real interest rates which are proving a drag on growth impulses,”

“We are going up in consonance with Asian markets,” Bagga added.

Advertisement

13:29 IST, November 19th 2024

Nifty SmallCap 100 surges 2%

Reflecting the surge in Sensex and Nifty, all the broader market indices were trading in green as of 01:19 pm with Nifty Smallcap 100 surging as much as 1.97 per cent. Though Nifty Midcap 100 also gained 1.72 per cent, the smallcap indices were outpacing the rest.

12:43 IST, November 19th 2024

Investors Reload Rate Hike Bets in Japan

Investors are betting a slide in the yen will force a hawkish shift at the Bank of Japan and are shorting bonds, buying bank shares and bracing for rates to rise as soon as next month.

Markets are paying attention because Japan's last rate hike 3-1/2 months ago - against the tide of global cuts - was part of the trigger for a chaotic surge in the yen that whipped around the world as positions funded in yen were quickly unwound.

Advertisement

12:15 IST, November 19th 2024

S&P To Reach 6,500 By 2025-end: Goldman Sachs

Goldman Sachs has forecast the S&P 500 index (.SPX) would reach 6,500 by the end of 2025, joining peer Morgan Stanley, on the back of continued growth in the US economy and corporate earnings.

The Wall Street brokerage's target implied an upside of 10.3% from the index's last close of 5,893.62.

()

11:58 IST, November 19th 2024

Asian stocks rise, dollar weak as US yields tick down

Asian stocks rose on Tuesday while U.S. bond yields and the dollar hung back from multi-month highs as traders awaited President-elect Donald Trump's cabinet selection and sought to gauge the outlook for Federal Reserve easing.

Tech shares advanced, tracking Wall Street's recovery from last week's steep losses, although Nvidia's upcoming earnings on Wednesday limited the scope for big moves.

Advertisement

11:31 IST, November 19th 2024

Govt plans minority stake sale in 4 banks

The central government is considering selling minority stakes in four state-run banks to comply with public shareholding norms mandated by the country's markets regulator, a government source told Reuters.

Advertisement

11:10 IST, November 19th 2024

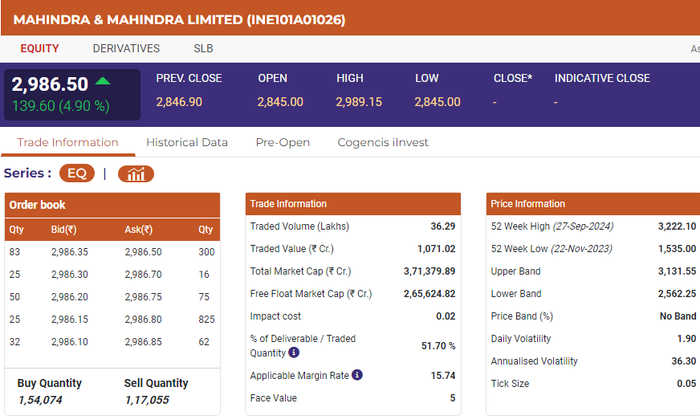

Sensex Surges Nearly 1,000 Points

Led by strong gains in stocks like Mahindra & Mahindra, Tech Mahindra, Adani Ports, and Titan, the domestic bourses are showing strong gains in Tuesday's trading session.

BSE's Sensex has surged 961 points or 1.23 per cent as of 11:10 am, hovering close to the mark of 78,300.

10:44 IST, November 19th 2024

Suzlon Energy Hit Upper Circuit

As Morgan Stanley upgrades Suzlon Energy to the 'overweight' category from ‘equal-weight,' the shares of the company hit the upper circuit with 5 per cent gains on Tuesday.

The shares of the company were trading Rs 62.37 apiece as of 10:44 am.

Advertisement

09:57 IST, November 19th 2024

Rupee Rises 2 Paise To 84.40 Against US Dollar In Early Trade

The rupee rose 2 paise to 84.40 against the US dollar in early trade on Tuesday amid a recovery in domestic equity markets and a weaker American currency against major Asian rivals.

Forex traders said, however, sustained outflow of foreign funds and an upward movement in crude oil prices put pressure on the local unit and capped its sharp gain.

09:38 IST, November 19th 2024

Mamaearth Parent Honasa Consumer Falls 12.7%

Honansa Consumer Limited, the parent company of Mamaearth, fell for the second straight session after hitting the lower circuit on Monday. After Monday's 20 per cent decline, the shares of Honasa Consumer fell another 12.7 per cent in the early trade on Tuesday.

The shares of the company were trading 37.70 points down at Rs 259.55 as of 09:37 am.

Advertisement

09:19 IST, November 19th 2024

Stock Market: Sensex Jumps 350 Pts Higher, Nifty up 0.44%, Infosys Leads

Stock Market Today: After a timid start to the week on Monday, the domestic bourses opened higher on Tuesday, November 19 with BSE Sensex surging 350 points or 0.5 per cent higher led by strong gains in Infosys, NTPC, and ICICI Bank. While on the other hand, the National Stock Exchange’s benchmark Nifty 50 opened 108 points or 0.44 per cent higher.

Sectorally, the market was led by an up move in Media, IT, Oil & Gas, and Auto stocks. Nifty IT which suffered strong losses on the first trading session of the week were trading 0.85 per cent higher in the early trade on Tuesday.

09:07 IST, November 19th 2024

Sensex, Nifty Set To Open Higher, Honasa, IT Stocks To Remain In Focus

After a timid opening on Monday, the domestic stock markets are set to open higher with Sensex likely to open 250 points higher while Nifty might inch up nearly 60 points.

Key IT stocks such as HCL, Infosys, Wipro, and Tech Mahindra set to remain in focus after Monday rout. Honasa Consumer Ltd which hit lower circuit yesterday with 20 per cent downside will also be keenly observed by the investors

Advertisement

08:28 IST, November 19th 2024

Long-term investors should invest now: Analyst

In the first half of November, FIIs offloaded Rs 29,533.17 crore in cash, while DIIs bought 26,522.32 crore. This small difference has dented our market by 11 per cent. Hereon, investors seeking short-term gains should wait while those with a 3-5-year investment horizon may consider allocating 30-40 per cent of fresh funds.

07:56 IST, November 19th 2024

GIFT Nifty Trades 57 Points Up

GIFT Nifty, an index derivative product that serves as an indicator for NSE's benchmark index NIFTY 50, was trading 57 points higher on Tuesday during the pre-market hours, nearing the mark of 23,582.

Advertisement

07:54 IST, November 19th 2024

Oil Prices Ease, But Caution Prevails Over Russia-Ukraine War

Oil prices retreated on Tuesday after the previous day's rally driven by halted production at Norway's Johan Sverdrup oilfield, but investors remained cautious amid fears of a potential escalation in the Russia-Ukraine war.

Brent crude futures for January delivery slipped 7 cents, or 0.1%, to $73.37 a barrel by 0119 GMT, while U.S. West Texas Intermediate crude futures for December delivery were at $69.23 a barrel, down 7 cents, or 0.1%. The more active WTI January contract fell 4 cents, or 0.1%, to $69.21.

07:49 IST, November 19th 2024

Nasdaq, S&P Close Higher As Investors Await Nvidia Earnings

The Nasdaq and S&P 500 closed higher on Monday, recovering some losses as investors anticipate quarterly earnings from AI leader Nvidia (NVDA.O), and Tesla (TSLA.O) jumped on the prospect of favorable policy changes from the incoming Trump administration.

Advertisement

07:49 IST, November 19th 2024

Dollar Rally Stalls, Giving Yen Respite

The yen got some much-needed respite on Tuesday as it steadied on the stronger side of 155 per dollar thanks to a pullback in the U.S. currency, which ran into profit-taking after a stellar rally that saw it scale a one-year high.

The yen last edged 0.2% higher to 154.40 per dollar, recovering from its fall in the previous session after Bank of Japan Governor Kazuo Ueda stuck to his usual script and failed to offer any hints on whether a rate hike could come in December.

07:53 IST, November 19th 2024