Published 12:30 IST, September 10th 2024

Big Pharma lacks motive to prep for new pandemics

The World Health Organization says the world should prepare for a virus that could be 20 times deadlier than Covid-19.

Advertisement

Jab cross. Covid-19 underlined critical importance of vaccines. pandemic caused 16 million global deaths, and current scare surrounding Mpox emphasises how citizens remain fearful of fresh outbreaks. That suggests Big Pharma groups should be ploughing resources into a vaccine arsenal to tackle next big virus. Yet right now y’re not, and it’s far from clear that y will.

World Health Organization says world should prepare for a virus that could be 20 times delier than Covid-19. Scientists call this hypotical virus Disease X, and reckon next outbreak could come from an unknown pathogen rar than an established virus like flu. This forecast is all more troubling given pandemics are alrey becoming more frequent.

Advertisement

Five out of past 12 pandemics occurred in 20th century, according to National Library of Medicine. Anor two occurred in 21st. Increased travel and more urban living are often cited as causes for more regular outbreaks: given frequency of travel, scientists estimate a dely pathogen can spre around world in a matter of hours.

This elevated risk poses a significant threat to world economy. International Monetary Fund estimated global cost of last pandemic was close to $13 trillion, reducing global GDP by 3% in 2020 alone. Health systems around world are still battling to clear record waiting times for essential services. With threat of anor crippling health emergency on cards, it stands to reason that Big Pharma companies would be investing in vaccines to deal with such an emergency.

Advertisement

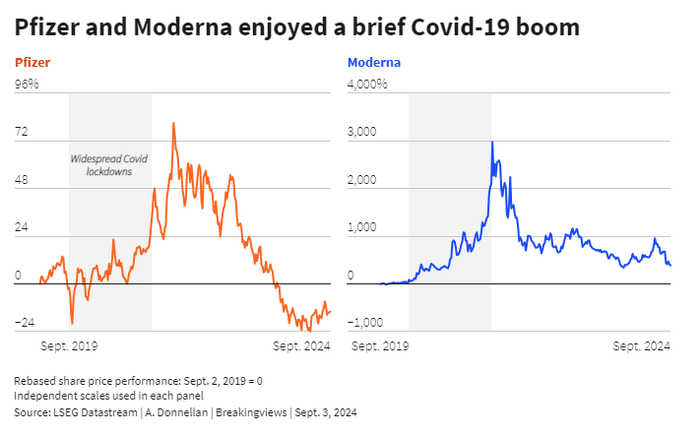

Drugmaker bosses don’t have to be nice guys to think this a good idea. If a company produces a winning vaccine for a dely virus, it stands to make a fortune. Pfizer’s market value increased by 80% to $337 billion between 2019 and 2022 thanks to its MRNA jab for Covid-19. Its operating profit more than doubled to $40 billion in same period. Meanwhile, Moderna’s share price increased 11-fold on same technology and it went from a more than $500 million operating loss to nearly $9.5 billion of profit in 2022.

Despite all this, drugmakers are not future-proofing against pandemics. Pfizer and AstraZeneca, $257 billion drug giant which also produced a Covid-19 vaccine during pandemic, are spending ir cash on boosting ir oncology franchises rar than churning out inoculations. Pfizer spent $43 billion on Seagen in an effort to double its cancer drug pipeline late last year. It has me no similar investment in battling future Covids. Meanwhile, AstraZeneca splurged $39 billion on Alexion in height of pandemic in 2021 in order to build up its rare disease portfolio, which positions it to win big if it comes up with a breakthrough for diseases that affect a small number of people. With little investment, re’s little hope that AstraZeneca’s vaccine and immune rapy business will grow beyond 2% of sales it accounted for last year.

Advertisement

At first blush, this reticence is peculiar. Investors d a 50% premium when valuing vaccine businesses versus or pharma units, one investor told Reuters Breakingviews. Historically, that means GSK’s relevant business would have been valued at around 15 times its expected EBITDA while its remaining pharma unit would only fetch about 9.5 times. Similarly, investors valued Sanofi’s pharma unit on 10.5 times while its vaccine business – which generates sales of nearly 7.5 billion euros, around 17% of French group’s total – is pencilled into models at 14 times EBITDA.

Yet this premium is not as helpful as it looks for helping world face down a new Covid. stability favoured by shareholders is largely reserved for vaccines where re will be stey demand, like flu jabs. Lower-frequency but high-impact diseases – likely to cause pandemics – are less likely to be prized as highly by market.

Advertisement

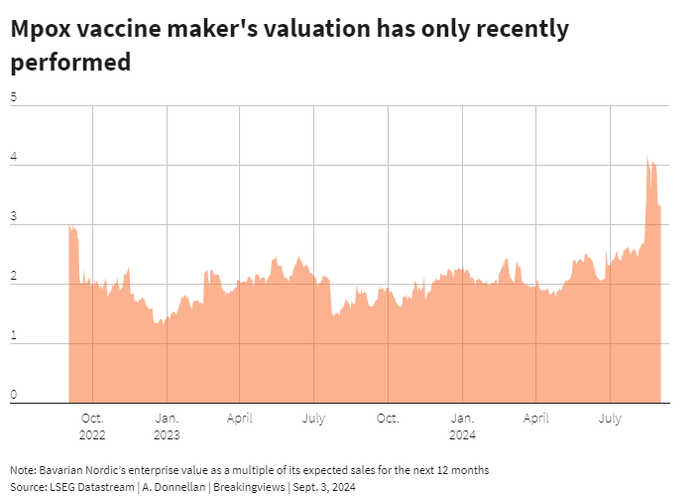

Mpox, as it happens, offers a live example of this. Denmark’s $3.1 billion Bavarian Nordic, which makes a jab for condition, has seen its shares jump by over 50% since beginning of year versus a 15% rise for S&P Pharmaceuticals Select Industry Index. Before that, investors gave company little credit for having an effective treatment for a dely disease. Last year, Copenhagen-based business tred on just 2 times sales, whereas it now tres at over 4 times.

post-Covid fates of stars like Pfizer and Moderna tell a similarly volatile story. Over last three years Pfizer shares have fallen 40%, while Moderna’s are off 80%. CEOs have little cause to make big vaccine punts if valuation sugar-rush is so brief.

Rolling dice on a niche-condition inoculation is, in any case, a risky step. In order to get approval from regulators like U.S. Food and Drug ministration, pharma groups need to display evidence that drug works in most cases. Yet those sorts of threshold make it harder for or drugmakers to compete with new products. That’s because regulators tend to frown upon enrolling patients in trials for vaccines when an alrey effective jab is on market.

On face of it, governments could step in where private sector is failing. A comprehensive global strategy would see countries cooperating on a plan to provide joint funding for new vaccines, meaning re could be some sort of strategic jab reserve against future pandemics. A version of this in train: health officials around world have been working towards so-called “100 day challenge” which would in same timeframe see an unknown pathogen identified, an inoculation created and manufactured, and a public rollout.

Yet public sector’s hopes of nailing a robust pandemic response seem just as forlorn. At World Health Assembly in May, countries couldn’t agree on how vaccines would be doled out in a future pandemic, and plans for a treaty outlining a pandemic response protocol came to nought. world’s hopes of devising a rapid jab in future refore rest on hoc public support for individual projects. This is not nothing – U.S. state funds helped Bavarian Nordic vance its Mpox treatment, for example. But given Covid-19 is less than five years old, taxpayers might find it odd that main strategy to avoid future equivalents is basically just to hope y don’t happen.

12:30 IST, September 10th 2024