Published 18:48 IST, August 30th 2024

Nvidia drives path Tesla would find familiar

The $3 trillion Nvidia on Wednesday reported revenue for the latest quarter that was 122% higher than the year before.

Re-raising the bar. Chipmaker Nvidia has become huge with astonishing speed. In that sense it’s a bit like electric carmaker Tesla. Both have boasted a huge lead in an industry that is creating dramatic transformation. And both are dealing with production hiccups and uncertainty over just how big their markets can become. The larger Nvidia gets, the higher the stakes.

The $3 trillion Nvidia on Wednesday reported revenue for the latest quarter that was 122% higher than the year before. Its performance beat analysts’ expectations on essentially every metric, according to Visible Alpha. The reaction: shares opened roughly 3% lower on Thursday. That can be explained with some minor disappointments: its adjusted gross profit margin fell slightly to a still-generous 76%, for example, the first sequential decline CEO Jensen Huang has served up in around two years. Its own estimates for next quarter’s results aren’t for a massive blow-out.

Nvidia isn’t quite priced to perfection the way Tesla is. Musk’s firm soared to a trillion-dollar valuation because of its breakthrough technology and peer-trouncing gross profitability. Yet when its market capitalization peaked, the shares traded at 156 times expected earnings, according to LSEG data. Nvidia trades at 38 times, roughly where it was the day before ChatGPT debuted, sparking the mania for artificial-intelligence models that are, more often than not, dependent on Nvidia’s chips.

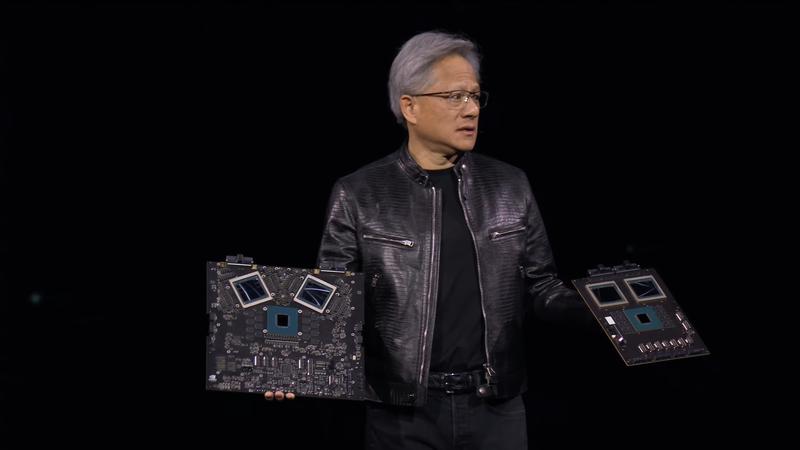

Tesla has already come down from the stratosphere, somewhat. What started as production woes snowballed into delayed product launches, rising competitive intensity, and led to Musk scrapping his growth targets. Tesla’s core gross margin, which excludes electric-vehicle credits from governments, has halved since 2022. Nvidia’s manufacturing wobbles are minor: its next-generation Blackwell chips are undergoing production tweaks, though Huang promised a speedy roll-out. That’s tame in an industry known for much worse upsets.

Still, it’s easy to understand skittishness when Nvidia is pushing against the bounds of the market, limited by factors only somewhat in its control. Musk has an advantage: investors give him leeway to promise that he will dominate everything from giant batteries to humanoid robots, awarding him credit ahead of time, regardless of setbacks. Nvidia, meanwhile, is more valued on its extraordinary achievements in its main business of chips and associated software. Huang is not promising to single-handedly colonize Mars. His valuation could be more easily brought back to Earth.

Context News

Chipmaker Nvidia on Aug. 28 said that it had generated over $30 billion in revenue in the three months to July 30, up 122% from the same quarter a year prior and roughly 4% above analysts’ expectations, according to Visible Alpha. Gross profit of around $23 billion was nearly 6% above estimates, while earnings of almost $17 billion were 11% above. The company, which designs chips crucial to artificial intelligence applications, said that it expected $32.5 billion in revenue next quarter, in line with expectations. Its projected gross margin of 75% narrowly trailed analyst estimates. Nvidia’s shares opened roughly 3% lower on Aug. 29. Shares of other leaders in AI, including Google owner Alphabet, Facebook parent Meta Platforms, Microsoft, and Palantir Technologies, were narrowly up.

Updated 18:48 IST, August 30th 2024