Published 12:14 IST, January 6th 2025

US 7-Eleven IPO Will Invite More Unwanted Suitors

7-Eleven is facing a takeover attempt by Canada’s Couche-Tard, plans to raise $6.3 billion by listing its US operations.

In 1987 Southland Corporation, the Dallas-based operator of 7-Eleven then facing rumours of a Canadian takeover attempt, announced plans to move the company into private hands—namely those of its founding family. Now the Ito clan behind the American chain’s current Japanese parent could end up listing those convenience store operations in their own bid to maintain control. It's an imperfect solution to a pressing problem.

The initial public offering of Seven & i's North American assets would seek to raise more than 1 trillion yen ($6.3 billion), following the proposed 9 trillion yen, roughly $57 billion, management buyout of Seven & i holdings led by the group’s founding Ito family, Bloomberg reported last month, citing sources.

That would help to pare down loans of 6 trillion yen planned to help finance the leveraged buyout and, by doing so, make the deal more palatable for the Japanese banks including Mizuho Financial and Sumitomo Mitsui Financial backing the bid intended to fend off a takeover approach from Canada’s Alimentation Couche-Tard.

Prior to Couche-tard's approach, the only planned IPO by Seven & i's management was that of its superstores business in Japan. This suggests listing the U.S. unit is mainly a result of Couche-Tard’s takeover bid, rather than a strategic move with long-term benefits for the group.

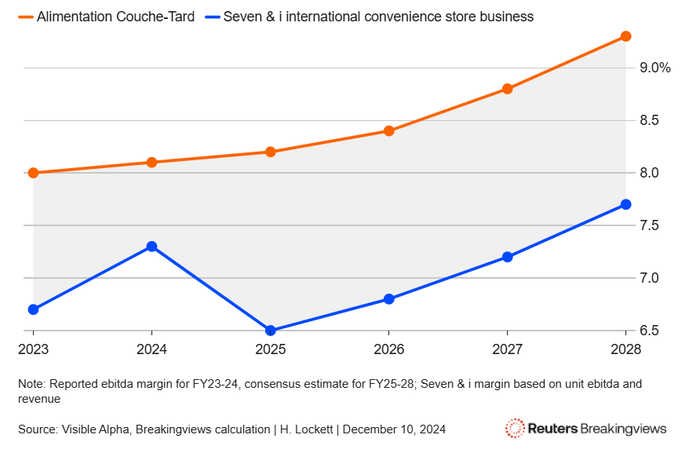

What's more, any new listing is likely to trade at a valuation discount to its unwanted suitor. The simplest yardstick for comparison is Seven & i’s global convenience store segment, given annual results show the U.S. business accounts for 95% of that segment’s external revenue.

The international business will generate EBITDA of 563 billion yen for the financial year ending February 2025, per Visible Alpha. On Couche Tard's multiple of 11, 7-Eleven US would be worth about $38 billion. That would require Seven & i to sell about 17% of the business to hit the reported fundraising target. But with profit margins lagging those of its rival-turned-suitor, it would probably command a lower multiple and need to sell more shares.

Seven & i's global corner store margins lag Couche-Tard

So while the promise of a listing may comfort banks financing a buyout and help to speed Seven & i’s exit from public markets, it risks creating a microcosm of the struggle that the family is contorting itself to avoid: Public scrutiny of its prized assets will increase, and more unwanted suitors may emerge.

Updated 12:14 IST, January 6th 2025