Published 20:08 IST, December 18th 2024

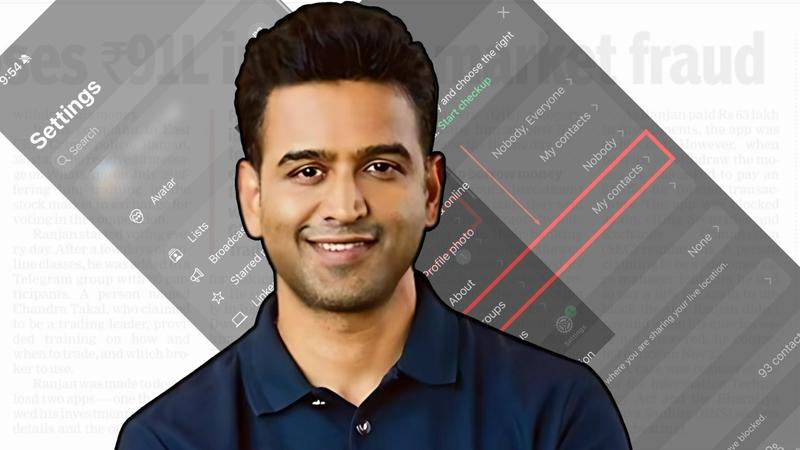

SEBI Algo Trading Rules: Zerodha's Nithin Kamath Shares His View

Sebi’s initiative seeks to create a more transparent and regulated environment for algorithmic trading in India.

Zerodha CEO Nithin Kamath has now offered his thoughts on Sebi's suggested guidelines for individual investors in algorithm trading.

On December 13, the Securities and Exchange Board of India (Sebi) released a consultation paper addressing algorithmic trading for retail investors. The proposal aims to simplify and regulate algo trading with proper safeguards. Public feedback on the draft circular is open until January 3, 2025.

In a post on social platform X, Kamatah said, "My understanding of it is it should be ok for savvy traders using APIs for individual trading with some reasonable order limits. But the APIs have to be accessed through only static IPs, but this isn’t hard to get. But platforms that offer algos or readymade strategies will need to get them approved through the broker. The broker, in turn, has to register all algos and strategies with the exchanges."

Key Proposals Of SEBI

- Registration of Algo Providers: Sebi suggests that algo providers must be registered and empaneled with exchanges.

- Algo Registration by Retail Investors: Tech-savvy retail investors who develop their own algos must register them with exchanges through their brokers.

- Framework for Governance: The new rules will ensure ease of use while implementing checks and balances for retail algo trading.

Comments from Zerodha CEO Nithin Kamath

Nithin Kamath, CEO of Zerodha, shared his insights on Sebi's proposed norms via a post on platform X:

- Individual Traders: Kamath mentioned that traders using APIs for personal trading would face minimal challenges, such as requiring static IPs, which are relatively easy to obtain.

- Approval for Algos: Platforms offering pre-built algos or strategies will need broker approval. Brokers must register these strategies with exchanges and ensure compliance.

- Infrastructure Responsibility: Kamath emphasized that brokers would need to provide infrastructure for customers to run their algos and ensure adherence to registered strategies.

Nithin Kamath On Implications

The proposed framework is designed to streamline retail algo trading while safeguarding against misuse. Sebi’s initiative seeks to create a more transparent and regulated environment for algorithmic trading in India.

“The broker also has to ensure that customers are following the same strategies that were registered. That means brokers will have to build and offer the infrastructure for people to run their algos and ensure compliance”, said Kamath.

Updated 20:09 IST, December 18th 2024