Published 19:27 IST, November 30th 2024

SBI credit card changes: New utility payment fees and reward policy rules from Dec 1

SBI Card will no longer award reward points for spending on digital gaming platforms or merchants

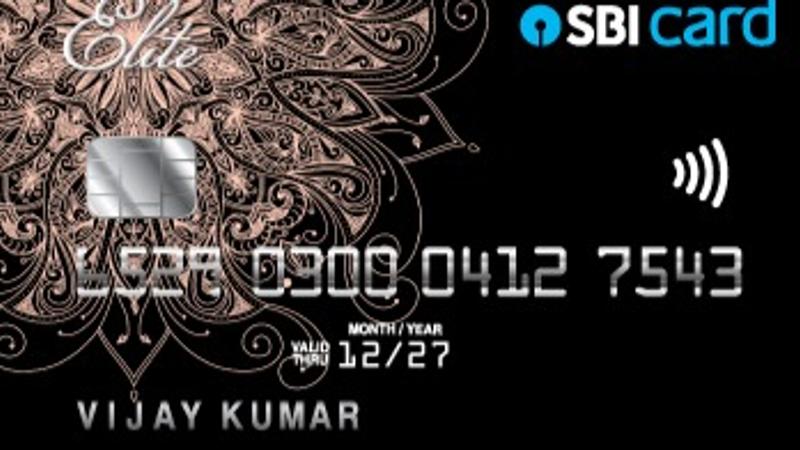

SBI Card, a subsidiary of State Bank of India (SBI), is introducing changes to its policies on utility payments and reward points starting from December 1, 2024. Here's what cardholders need to know.

SBI Card: 1% Fee on Utility Payments Over ₹50,000

From December 1, 2024, a 1 per cent fee will be applied on utility payments exceeding Rs 50,000 within a billing cycle. This applies to payments for services like electricity, water, gas, and other utilities. No fee will be charged for payments under Rs 50,000 in a billing cycle. This change builds on a similar fee structure introduced in November 2024.

Discontinuation of Reward Points for Digital Gaming:

Starting December 1, 2024, SBI Card will no longer award reward points for spending on digital gaming platforms or merchants. This change affects various SBI Card types, including:

- Premium Cards: AURUM, SBI Card ELITE, ELITE Advantage

- Lifestyle Cards: SBI Card PRIME, PRIME Advantage, PRIME Pro

- Shopping Cards: SimplyCLICK SBI Card, SimplyCLICK Advantage

- Savings Cards: SimplySAVE SBI Card, SimplySAVE Advantage

- Gold Cards: Gold SBI Card, Gold Advantage, Gold Defense

- Partner Bank Cards: KVB, Karnataka Bank, City Union Bank SBI Cards

- Employee & Merchant Cards: SimplySAVE Merchant SBI Card, SimplySAVE UPI SBI Card

- Other Cards: SHAURYA SELECT SBI Card, Krishak Unnati SBI Card

Discontinuation of Club Vistara SBI Cards

In September 2024, SBI Card also announced the discontinuation of the Club Vistara SBI Credit Cards and Club Vistara SBI Credit Card PRIME. These changes reflect a change in the focus of SBI Cards, which will affect consumers who regularly use their cards for expensive utility bills or gaming-related costs. In order to properly adjust to the new charge structure and incentive schemes, cardholders are recommended to examine their spending habits. While new issuances stopped on September 28, 2024, existing cardholders can continue using their cards.

Updated 19:30 IST, November 30th 2024