Published 22:17 IST, January 8th 2025

Rent vs Buy; EMI Or Monthly Rent? What Works Better In 2025?

Explore expert insights on metro rental costs, 2BHK purchase prices, EMI breakdowns, tax benefits, and financial dynamics to make an informed decision.

Is it smarter to rent or buy a home in 2025? With skyrocketing property prices, fluctuating interest rates, and evolving tax laws, the choice between renting and buying is very confusing. To cut through the confusion, Republic Business spoke to Ashish Kukreja, CEO and Founder of Homesfy. He breaks down metro market trends, rental costs, home-buying expenses, and tax benefits to help you make an informed choice in 2025.

Republic: What is the average monthly rent for a 2BHK in key areas like Mumbai, Bengaluru, Delhi, Pune, and Hyderabad in 2025?

Expert: The monthly rents for mid-segment 2 BHK in key cities vary significantly. In Mumbai, the rent ranges from Rs 45,000 to Rs 85,000, while in Delhi, it is between Rs 30,000 and Rs 60,000. In Bengaluru, rents range from Rs 25,000 to Rs 55,000, and in Pune, they fall between Rs 20,000 and Rs 45,000. Lastly, in Hyderabad, the rental prices range from Rs 20,000 to Rs 60,000, according to industry sources. Most 2 BHKs fall within these ranges; however, specific locations, sizes, and other factors can lead to even higher rents.

Republic: What are the typical upfront costs (e.g., deposit, brokerage) for renting in these cities?

Expert: Typical brokerage charges when renting a house involve 1 month's rent from the tenant and landlord each. For cities like Bangalore, Mumbai, and Delhi, this could range from 1 to 3 months. For example, if a property rents 40K, the broker will charge 40K from the tenant and landlord. In regions like NCR, half a month's rent is observed as a brokerage.

As per the Model Tenancy Act (MTA) 2021, the deposit amount cannot exceed two months' rent, but the law is revised in only four states: Tamil Nadu, Uttar Pradesh, Andhra Pradesh, and Assam. Considering the current rental trends, the monthly security deposit charges vary in each city, typically charging 1-2 months of rent for the residential property. However, in Mumbai, you can expect the security deposit to go as high as 6 months' rent for the property.

Republic: What is the average cost of purchasing a 2BHK in the same areas?

Expert: Considering mid-segment buyers in the suburbs of the cities, the average cost of purchasing a 2 BHK in Mumbai ranges from Rs 1.5 Cr to 2.75 Cr, Bengaluru Rs 50 Lakhs – Rs 1.70 Cr, Delhi Rs 60 Lakhs to Rs 2 Cr, Rs Pune 40 Lakhs to Rs 1.50 Cr, Hyderabad 70 Lakhs to Rs 1.5 Cr. These prices highly depend on factors like location, size, and the kind of offering the developer is selling, for the premium and luxury segments, the prices can go much high.

Republic: For a Rs 1 crore property, how much would the total cost come to after adding stamp duty, registration fees, and maintenance?

Expert: The average maintenance charges for residential properties vary significantly across different cities in India. In Mumbai, they range from Rs 2 to Rs 25 per square foot. The charges in Delhi, Pune, and Hyderabad are approximately Rs 3.5 to Rs 4 per square foot. In Bengaluru, the costs are slightly lower, ranging from Rs 2.8 to Rs 3.5 per square foot. Maintenance costs are influenced by several factors, including the amenities offered and the quality and type of construction. They are often higher for premium and luxury developments. Maintenance costs typically amount to about 0.25% to 0.75% of the flat's construction cost.

Republic: What would the EMI look like for a 20-year loan at 8.5% interest?

Expert: For a residential apartment costing Rs 1 Cr all-inclusive, considering a 20% down payment, a loan of around Rs 80 Lakhs would be required. For a 20-year tenure at 8.5% interest, the monthly EMI would be Rs 69,426.

Republic: For someone renting a 2BHK for Rs 30,000/month, how much would they spend in 10 years (factoring in rent increases)?

Expert: The maximum rent increase in India is generally 10% for residential properties. For a monthly rental of Rs 30,000, an individual would pay Rs 3,60,000 yearly. Over 10 years, with a 10% annual rent increase, the total rent paid would amount to approximately Rs 57,37,000.

However, rental increases vary in different cities. For example, in Mumbai, the rental increase can go up to 24% if any structural change occurs, 10% of the last paid rent once in 3 years in Delhi, and up to 10% in Bengaluru. The rental increase in each city comes under local jurisdiction. Researching current trends and understanding the rental agreement thoroughly before deciding is always advisable.

Republic: For someone buying a Rs 75 lakh property, how much will they pay in EMIs and maintenance over 10 years? Could you share a side-by-side comparison of costs for both options?

Expert: To calculate the total payments for someone buying a property worth Rs 75 lakhs, we need to consider some assumptions:

- Down payment = Rs 10,00,000

- Loan Amount = Rs 65,00,000

- Interest Rate = 8.5% annually

- Loan Tenure = 10 years (120 months)

- Maintenance = Rs 5,000 per month

- Total maintenance over 10 years = Rs 6,00,000

Breakdown of Payments:

- EMI (Equated Monthly Installment): approx. Rs 80591 per month

- Total EMI Payment over 10 years: approx Rs 96,70,920

- Total Maintenance over 10 years: Rs 6,00,000

- Total Payment (EMI + Maintenance): Rs 1,02,70,920

Thus, over 10 years, the buyer will spend approximately approx. Rs 1.02 crore in EMIs and maintenance combined.

Here’s a detailed side-by-side comparison of the Rent vs Buy options over 10 years

Republic: At what point does buying a home become more financially beneficial than renting? Can you provide an example with numbers?

Expert: As we can see from the above example, total expenditure is significantly lower (Rs 57.4 lakh). Still, it does not result in ownership or asset creation, and expenses will continue indefinitely until the renting period continues. A 10% rental increase yearly will result in you paying triple/quadruple the rental amount in 20 to 25 years.

There are higher upfront and ongoing costs (Rs 1.02 crore) when buying, but the property becomes a valuable asset. If property values appreciate, as they have over the years, the investment's long-term value offsets the higher costs.

Republic: What is your advice for 2025: Should people focus on renting or buying, considering factors like rising property prices and interest rates?

Expert: The housing market will record a modest single-digit rise in property prices in 2025, and interest rates are expected to drop, helping affordability improve significantly. Micro markets are increasing demand and appreciation, attracting end users and investors. Buying vs renting has always been debatable, and decisions about it are taken considering many factors, of which budget remains at the top. However, buying would always be the best option in the long term, as it will help the user build a long-lasting asset. The result could be exponential when combined with the benefits of real estate returns. As the saying goes, the best time to invest in real estate was 5 years ago.

Republic: Which areas in metros (like Mumbai, Bengaluru, and Delhi) offer the best value for buying a home? Could you suggest neighborhoods that are affordable yet have good growth potential?

Expert: Over the years, areas with infrastructure development have seen incremental growth in terms of the value of investment in the metro cities. For instance, the development of Navi Mumbai International Airport and Atal Setu in Mumbai attracted a lot of investors in the Mumbai MMR region; for any homebuyer or investor, it is foremost to consider commercial developments and infrastructure developments in the prospective region to get the best value for a home. The government is investing heavily in connectivity by introducing expressways and multi-modal corridors to reduce travel time. Neighborhoods with upcoming developments attract top developers for their offerings with attractive pricing compared to others and should be considered for affordable yet good growth potential.

Republic: For renters, what should be their average monthly budget for a 2BHK in key areas? Are there any cities where renting makes significantly more sense?

Expert: Rental pricing is very subjective to each individual and their lifestyle, varying from locality to locality. On a generic note, a monthly budget of 40,000 to 1,20,000 should be considered for a 2 BHK in the suburbs of Mumbai. In Delhi, 25,000 to 40,000, Bengaluru 35,000 to 60,000, Pune 15,000 to 50000, and Hyderabad 15,000 to 35,000. These prices change significantly depending on the property, amenities, neighborhood, connectivity, and other factors.

Renting or buying is an individual preference. For a bachelor, renting would make more sense. An individual or family who has to settle in a city will go for buying, whereas a person who is present in a town just for a job would like to invest in a residential property in their hometown. It boils down to individual use cases.

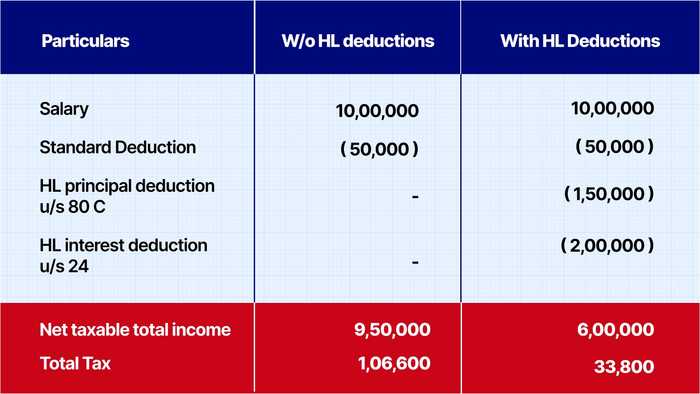

Republic: How do tax benefits on home loans impact the decision to buy a house? Could you give an example of how much one can save on taxes annually for a Rs 50 lakh home loan?

Expert: Tax benefits on home loans are a beneficiary when buying a home. Consider the below example

An individual with a salary of 10 lakhs, can save upto Rs 73000 approximately

Republic: For renters, is there a financial advantage to investing the money saved (e.g., down payment) into other assets instead of buying property?

Expert: Renting while investing the money saved can be a wise financial move, particularly for those who prioritize high-growth assets and are financially disciplined. However, home purchasing can provide stability, possible tax advantages, and the emotional joy of home ownership. Ultimately, the decision between the two is based on personal objectives, financial practices, and market conditions.

Significant tax benefits, such as deductions for property taxes and mortgage interest, are frequently associated with homeownership and unavailable to renters. Property values can rise significantly in quickly growing real estate markets, providing homeowners with the possibility of significant returns. Additionally, because mortgage payments help to accumulate wealth over time, home ownership is a forced savings mechanism. Conversely, renters must rely on financial discipline to invest their savings consistently and effectively to achieve similar long-term gains.

Updated 22:22 IST, January 8th 2025