Published 17:24 IST, November 7th 2024

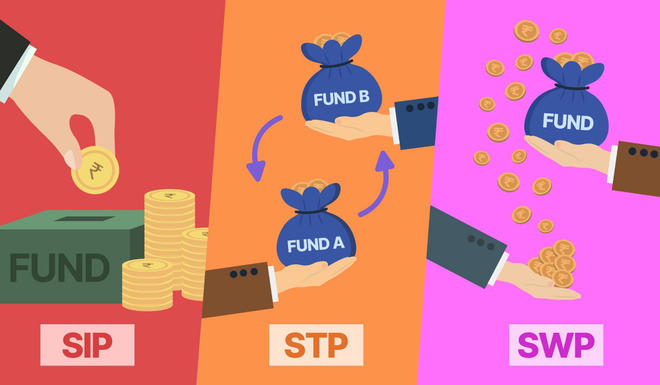

SIP, STP, or SWP: Which mutual fund strategy should you choose?

SIP, STP, or SWP: From regular investments to managing large sums, know how each strategy works and find the best fit for your financial journey.

Mutual fund strategy: If you’re planning to invest in mutual funds, you’ve likely heard about SIP, or Systematic Investment Plans. SIPs are a reliable way to grow your wealth through small, regular investments. However, there are other lesser-known but equally effective strategies: STP (Systematic Transfer Plan) and SWP (Systematic Withdrawal Plan).

What is a Systematic Investment Plan (SIP)?

SIP allows you to invest a fixed amount in mutual funds at regular intervals, typically monthly. It’s a disciplined approach that doesn’t require you to time the market.

Imagine you decide to invest Rs 5,000 each month in an equity mutual fund. No matter what the market condition is, you invest this amount consistently. Over time, this approach averages your buying price and helps mitigate market volatility, especially in the long term.

Who should use SIP?

SIPs are ideal for new investors, salaried professionals, or anyone looking to build wealth over the long term without needing to actively manage their investment. It’s perfect for those aiming for goals like retirement, a child’s education, or wealth accumulation.

Experts advise starting early and stay consistent. SIPs work best over longer periods, as compounding amplifies returns.

What is a Systematic Transfer Plan (STP)?

STP lets you transfer a fixed amount from one mutual fund (usually a debt or liquid fund) to another (like an equity fund) at regular intervals. This strategy can be a safer way to enter more volatile funds.

Suppose you received a lump sum, say Rs 5 lakh, and want to invest it in equity mutual funds. Instead of investing the entire amount at once (which can be risky if the market dips), you invest it in a liquid or debt fund and use an STP to gradually move Rs 25,000 each month into an equity fund. This approach spreads your investment, potentially lowering your risk.

Who should use STP?

STPs are ideal for those with a large lump sum who want to avoid putting it all into equities at once. This approach can suit individuals nearing retirement, people investing an inheritance, or anyone risk-averse wanting to transition from a safer fund to a riskier one.

STP is best used to gradually move funds from debt to equity when you expect equity markets to perform well in the future. This gradual shift can also be helpful during market corrections, say experts.

What is a Systematic Withdrawal Plan (SWP)?

SWP allows you to withdraw a fixed amount from your mutual fund investment at regular intervals. It’s an excellent option for investors seeking a steady cash flow while letting the remaining investment grow.

Let’s say you invested Rs 10 lakh in a mutual fund and want a monthly income of Rs 10,000. You set up an SWP to withdraw this amount each month. The fund will redeem units equivalent to Rs 10,000, and the remaining amount stays invested, potentially continuing to grow.

Who should use SWP?

SWPs are great for retirees or anyone who needs a steady cash flow without depleting their entire investment. They’re also ideal for meeting regular expenses, such as EMIs, school fees, or monthly household needs.

Experts advise choosing funds with moderate risk if you’re using an SWP for long-term cash flow. Avoid withdrawing too much to ensure your principal amount lasts.

"Choosing the right mutual fund strategy depends on your specific financial goals," said Ravi Singh, SVP - Retail Research

Religare Broking.

"If you're just starting out, SIPs offer a simple and disciplined way to invest regularly and build wealth over time. For those with a lump sum, STPs provide a smart approach to transition into equities gradually, managing timing risks in volatile markets. Meanwhile, SWPs are ideal for those seeking a steady income stream, particularly retirees, as they allow you to receive regular cash flow while keeping a portion of your investment growing," Singh added.

Choosing between SIP, STP, and SWP ultimately depends on your current financial situation, your goals, and how much involvement you want in managing your investments. Each plan serves a unique purpose, so use them strategically to maximise returns, minimise risk, and achieve the financial stability you’re aiming for.

Updated 18:55 IST, November 7th 2024