Published 06:29 IST, September 3rd 2024

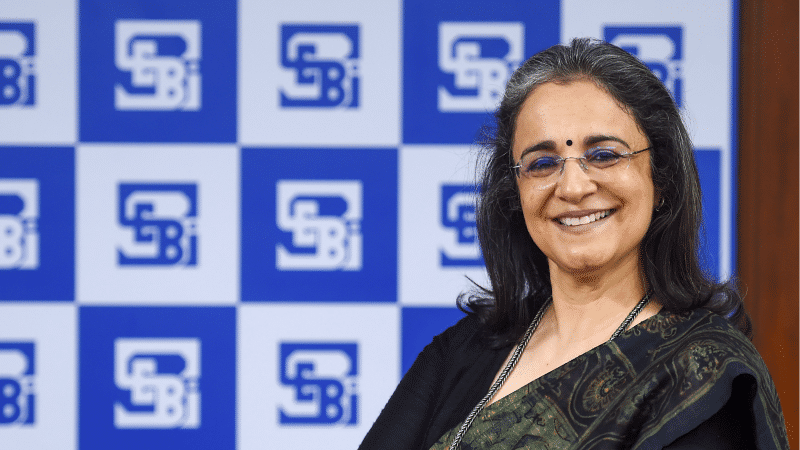

SEBI’s Madhabi Puri Buch proposes Rs 250 SIP to enhance financial inclusion

This initiative, driven by Aditya Birla Sun Life Mutual Fund, aims to make investing more accessible to a larger segment of the Indian population.

SEBI’s Rs 250 SIP proposal: SEBI Chairperson Madhabi Puri Buch has proposed the introduction of a Rs 250 per month systematic investment plan (SIP).

This initiative, driven by Aditya Birla Sun Life Mutual Fund, aims to make investing more accessible to a larger segment of the Indian population.

Affordable SIP with technology

Addressing a Confederation of Indian Industry (CII) event, Buch stressed that the proposed Rs 250 SIP is designed not only as a low-cost investment option but also to leverage technology for streamlined onboarding and servicing.

She highlighted that discussions are underway with the Association of Mutual Funds in India (AMFI) and other key industry players to ensure the feasibility of this initiative.

“This Rs 250 SIP will provide an opportunity for more people to invest, with amounts as low as ₹250 per month, approximately $3,” Buch explained.

She highlighted that such a minimal investment could democratize wealth creation, aligning with the vision of a 'Viksit Bharat' (developed India).

“Globally, people are amazed when I mention this amount. It’s a significant step towards inclusive financial participation,” she added.

The move by Aditya Birla Sun Life Mutual Fund represents a pioneering effort in the Indian mutual fund sector. If successful, it would set a new precedent for low-cost SIP offerings in the country.

However, Buch clarified that the initiative's success depends on its viability, stressing that without it, traction could be limited.

Tech-driven market future

Buch also addressed the future of the market ecosystem, pointing out that advancements in technology will play a critical role. She praised the Indian market for its leading-edge technological developments, which are unparalleled globally. “Our market is at the forefront of technology innovation,” she said.

The SEBI Chairperson underlined the importance of collaboration between regulators and industry stakeholders. “Effective regulation involves co-creation and partnership. This approach is essential given the complexity of our market ecosystem,” she concluded.

As the mutual fund industry prepares for this potential shift, the focus will be on ensuring that the Rs 250 SIP can be both viable and impactful in expanding financial inclusion across India.

Updated 06:29 IST, September 3rd 2024