Published 14:55 IST, December 27th 2024

How To Create Your First Rs 1 Crore With Mutual Fund SIPs? Tenure, Return, SIP Amount

It is completely possible to achieve your first 1 crore if you can learn how to process in this regard and invest wisely and diligently.

The goal is to reach the golden number—their first one crore. Why is one crore such a significant amount? This milestone stands for the wisdom of money and achieving financial stability in the long run. The aim to achieve your 1 crore can be both a dream and a daunting journey. While so many people might think of it as impossible. It is completely possible to achieve your first 1 crore if you can learn how to process in this regard and invest wisely and diligently.

Let us deep dive into this and we will try to solve this topic using simple steps to help you achieve your first 1 crore using the right strategy and planning.

Starting Early Helps

Time plays a crucial factor when it comes to investing. You can give yourself enough time to let the power of compounding take over. SIP, or Systematic Investment Plan, is the most popular and relevant factor in achieving your first 1 crore.

Talking on this front, Trivesh D, COO of Tradejini Financial Services, says that the importance of starting early with SIPs lies in the power of compounding.

“The earlier you start, the more time for your investments to grow, which can make a huge difference when aiming for Rs 1 crore. Beginning in your 20s builds a solid foundation, helping you achieve milestones like education or marriage in your 30s and 40s. Starting early gives you more time to reach your goal without stress,” he said.

Talking on the same, Rachit Khandelwal, Investment Advisor and Head of Research & Investor Education at BNK Capital Group, said that early investments allow more time for returns to compound, significantly boosting wealth.

“Starting early reduces the monthly SIP amount needed to reach Rs 1 crore. A longer time horizon helps ride out market volatility and improve risk management”.

Plan Better To Achieve

The goal of determining your financial planning should be the topmost. The majority of people save and then think about investing. However, the plan to invest needs to be decided beforehand to understand the financial gap.

Investors are constantly looking for better investing opportunities. The market offers a variety of choices, including hedge funds, Systematic Withdrawal Plans (SWP), Unit Linked Insurance Plans (ULIP), Equity Linked Saving Schemes (ELSS), and many more.

However, the most prominent are mutual funds, where more than 81 lakh investor accounts were opened in 2020, and systematic investment plans (SIPs), where about 91.8 billion net flows of SIPs were recorded in March 2021, according to RBI statistics.

Investment Through Mutual Funds:

Mutual funds are a way of investment where the investment is made in a lump sum form. Various mutual funds strive to attain various objectives, such as small-cap, mid-cap, and large-cap funds; index funds, etc.

Since the funds are diversified into various assets with variations in investment horizons, it reduces the risk of market volatility. With a decreased risk in the portfolio, the loss in one asset is compensated by gains in another.

The portfolio held by an individual investor constitutes stocks, bonds, and commodities. This portfolio is operated by a finance manager, also known as a fund manager.

Trivesh D talks about common mistakes that investors should avoid while aiming for Rs 1 crore through mutual funds.

“ Avoid stopping or reducing SIPs during market downturns, as staying disciplined yields long-term benefits. Regularly reviewing your portfolio ensures it aligns with your evolving financial goals. Additionally, inadequate diversification can increase risks, so spreading investments across different funds is essential. Finally, remember that wealth creation takes time: patience and consistency are key.”

The Popular Game Of SIP

SIPs are comparable to mutual funds, except most mutual fund investments are done in a lump sum. However, with SIP, a tiny sum is regularly and continuously placed in the fund on a monthly or quarterly basis.

SIP allows you to invest at least Rs 500 per quarter or month. A fund manager is designated to make investments in the market on behalf of clients in a variety of industries, including stocks, bonds, and real estate. The fund manager is responsible for maximising profit while minimising risk.

Compounding, which allows interest received on the principal value to be reinvested, is one of the main advantages of investing in SIP. Over time, investors generate a greater return on profit.

Narasimha Kumar, CEO of Akshaya Money Management, said that SIPs are widely regarded as a good option for long-term wealth creation and disciplined financial planning, as there is no need to time the market.

“It is suitable for all types of investors, including beginners with reduced risk of market volatility. It can help in achieving financial goals like retirement, education, or buying a home”.

He gave the formula to achieve your first Rs 1 crore via SIP investment.

Example Calculations:

Let’s assume an expected return (CAGR) of 12% per annum.

For 10 years:

SIP needed = Rs 43,000/month approximately.

For 15 years:

SIP needed = Rs 21,000/month approximately.

For 20 years:

SIP needed = Rs 12,000/month approximately.

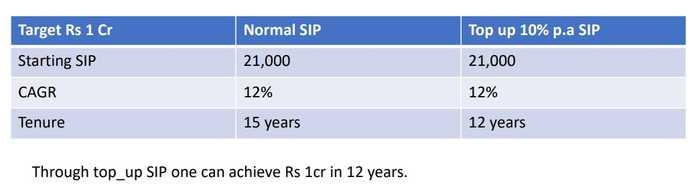

The best practice in SIP is top-up SIP, which allows you to increase the SIP amount periodically.

Let us take an example for Rs 15 years to achieve Rs 1 Cr.

Kumar talks about ways to mitigate risks in SIPs and how to handle market volatility during the SIP tenure to stay on track.

He advised diversifying the portfolio to avoid over-concentration in a single fund or sector.

- Stick to Your Investment Horizon: SIPs work best over extended periods due to rupee cost averaging and compounding.

- Choose Funds Based on Risk Appetite: Assess your risk tolerance and financial goals before selecting funds. Opt for conservative funds like balanced or index funds if you are risk-averse.

- Monitor and Rebalance Regularly: Periodically review fund performance and rebalance your portfolio to align with your goals and market conditions.

- Use Professional Guidance: Consult a financial advisor to choose funds suited to your goals and risk profile.

- Avoid Emotional Decisions: Do not stop SIPs during market downturns; instead, view them as opportunities to buy more units at lower prices.

Power of compounding

It is important to understand the power of compounding to understand the movement of investment over time. The power of compounding is simply the process of 'adding interest on interest,' which means that the amount of money you invest generates returns from both the initial principal amount and the cumulative earnings from previous compounding periods. Eventually, it will grow your money over time.

“Compounding lets your returns earn returns, accelerating growth over time. The longer you stay invested, the greater the impact. For example, investing Rs 5,000 monthly at 12% returns over 10 years could grow to Rs 11.61 lakh. SIPs maximise compounding by enabling small, consistent investments.”, Trivesh D noted.

Noting the importance of compounding, Khandelwal talked about reinvested returns.

“Gains from SIPs are reinvested, earning returns on both principal and previous earnings. Over time, compounding accelerates the growth of your investment exponentially. Even small amounts grow significantly when invested for a longer period,” he said.

Tools For Calculating SIP Investments

Trivesh D shared some tools to calculate your investment and returns. One of the tools is Cube Plus, which can be used to calculate the SIP investments effectively.

“It allows you to input your investment amount and expected returns by looking into expected returns based on the past performance of mutual funds and duration to estimate your corpus.” He added.

Khandelwal advised using mobile apps that provide goal-planning features. He talked about robo-advisors who can help with fund selection and SIP optimisation based on individual goals and risk profiles.

“AMFI & AMC Tools provides free tools by AMFI and mutual fund companies to assist in planning.” He added.

Also Read: Stock Split: This Stock Will Split Into Five, Board Approves Stock Split – Check Details | Republic Business

Updated 18:31 IST, December 27th 2024