Published 13:23 IST, December 20th 2024

Buying Stocks With 'Borrowed Money': Zerodha Launches Scheme

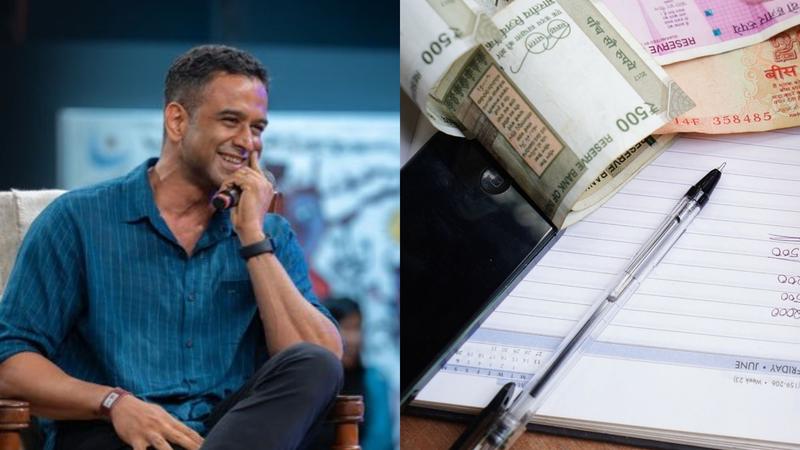

Zerodha CEO Nithin Kamath has announced the launch of Margin Trading Facility (MTF), enabling users to borrow funds to buy stocks for delivery.

Zerodha, India's largest brokerage platform, has launched the Margin Trading Facility (MTF), a feature allowing users to borrow funds for equity delivery trades. This launch comes despite initial reservations from the company's CEO, Nithin Kamath, about market timing and the risks associated with leverage. The announcement was made via a post on X, formerly Twitter.

"I don’t know if it is a good time with the fall in the markets , but we are finally launching MTF (margin trading facility) which allows you to buy stocks for delivery by borrowing money from us," Kamath shared.

Understanding MTF

MTF provides traders with leverage, enabling them to buy stocks without having the entire trade value upfront. At Zerodha, users can borrow up to 80% of the trade value, depending on the stock, with an interest rate of 0.04% per day (equivalent to Rs. 40 per lakh per day) on the borrowed amount. This position remains active until the funds are repaid or the stock is sold.

Kamath highlighted the risks, stating, "Customers who trade for delivery tend to ignore the impact of the cost of borrowing, and there’s always the risk of the trade going against them, which leads to a bigger loss."

Balancing Demand and Risk

Over the past three to four years, MTF has gained significant traction in the industry. "Considering the number of customers asking us for the feature, it didn't make business sense for us to not offer it," Kamath admitted. However, he reassured users of Zerodha’s philosophy of not pushing products. "We will never push this to customers and trigger them to trade," he said.

Costs and Caution

Borrowing via MTF incurs a daily interest cost that can quickly erode potential profits. Additionally, falling stock prices may require users to add more margin or close their position, amplifying risks. Zerodha also charges standard brokerage fees (0.03% or Rs 20 per order) and additional pledge and square-off charges for MTF transactions.

As per Zerodha, the pricing structure, comparing it to Zerodha’s Loan Against Securities (LAS) product. "MTF has a higher interest rate than LAS provided by our NBFC Zerodha Capital at 11.5% because the margin provided is much lesser for LAS, and hence, the trade carries significantly less risk."

Updated 13:23 IST, December 20th 2024