Published 15:47 IST, December 9th 2024

First Time In 14 Years: China Changes Monetary Policy To 'Moderately Loose' - What Does It Mean?

Alongside the monetary policy shift, China plans to implement a more proactive fiscal policy to spur growth in the nation.

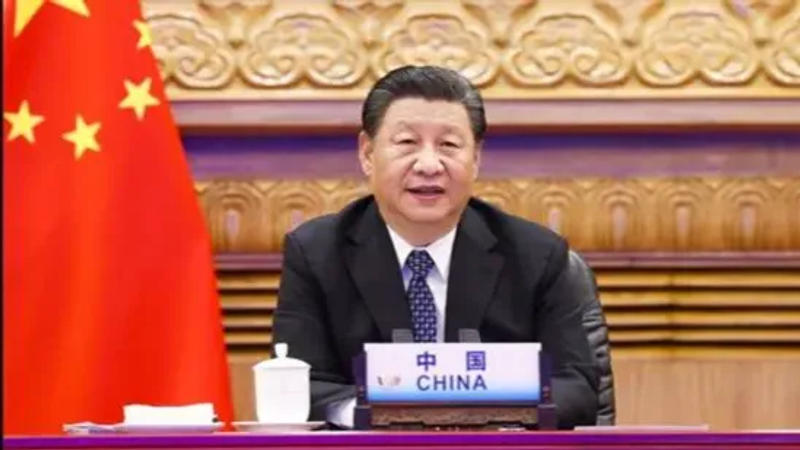

China has announced a significant shift in its monetary policy stance, marking the first easing of its approach in 14 years. In a meeting of the top Communist Party officials, the Politburo revealed plans to adopt a "moderately loose" monetary policy and pursue more proactive fiscal measures in 2025. This change aims to boost economic growth amid rising concerns over stalled growth and mounting pressures from domestic and international factors, including a weakened property market and potential trade tensions with the United States.

Key Policy Shifts: "Moderately Loose" Monetary Stance

The decision to ease monetary policy is the most notable change since China moved to a "prudent" policy in 2010. According to the official readout from the Politburo meeting, the new policy is described as "appropriately loose," which is seen as a departure from the previous cautious stance. The shift is part of a broader strategy to enhance economic recovery through aggressive measures, including potential interest rate cuts and increased government spending.

The focus will be on expanding domestic demand, boosting consumption, and stabilizing key sectors such as the property and stock markets. The government aims to counter the ongoing economic challenges, including a property market slump that has significantly impacted consumer confidence and spending.

Economic Stimulus and Fiscal Support

Alongside the monetary policy shift, China plans to implement a more proactive fiscal policy. This will involve measures designed to stimulate the economy, with a particular emphasis on counter-cyclical adjustments. These adjustments are aimed at mitigating the adverse effects of the economic slowdown and are expected to include a mix of fiscal stimulus, debt issuance, and other support mechanisms aimed at boosting domestic demand and consumer spending.

The Politburo emphasized the importance of stabilizing key markets and boosting consumption across various sectors. The government is also expected to unveil more concrete measures at the upcoming Central Economic Work Conference, which will outline specific targets and initiatives for the year ahead.

Stock Market Reaction: Surge in Investor Confidence

Following the announcement, Chinese stock markets saw a sharp uptick, with the Hang Seng index rising 2.8 per cent to its highest level in a month. Investors responded positively to the news, particularly in sectors such as technology, banking, and property, with stocks in these areas showing significant gains. The bond market also saw a strong rally, with government bond yields hitting record lows, reflecting market expectations of further monetary easing in the months ahead.

Updated 16:46 IST, December 9th 2024