Published 12:44 IST, November 8th 2024

Fed’s victory lap runs into Trump-shaped detour

The US Federal Reserve’s FOMC on Nov. 7 unanimously voted to lower the benchmark overnight interest rate by 25 basis points to a target range of 4.5%-4.75%.

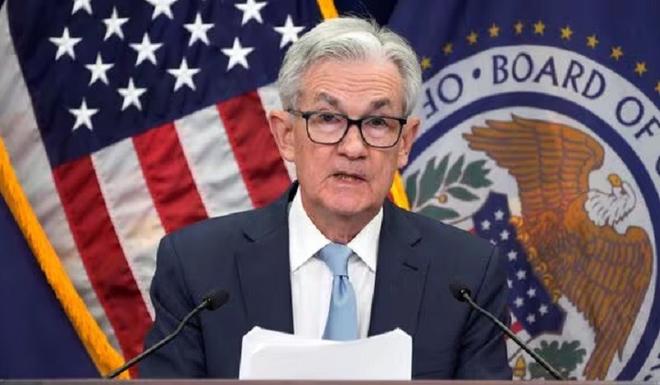

Fed to the wolves. Jerome Powell’s hard work is in danger of coming undone. The U.S. Federal Reserve chair and his Federal Open Market Committee colleagues reduced benchmark interest rates again on Thursday, after having threaded the needle of taming inflation without impeding GDP growth or hurting the job market. President-elect Donald Trump’s avowed policies and meddling tendencies threaten to cut the success story short.

After voting to lower borrowing costs by a quarter percentage point to a 4.5% to 4.75% target, Powell was put in the awkward position of fielding questions about the Fed’s future. High prices during President Joe Biden’s tenure contributed to Trump’s Oval Office comeback. Even though inflation is back down to a 2.4% annualized rate and unemployment sits at 4.1%, the Fed will face a hostile White House.

Trump’s stated plans to impose 20% tariffs on foreign goods, extend existing tax cuts and implement new ones, and roll back regulations are changes that could easily push up prices again. Importers will pass the cost of higher levies onto consumers and the government will have to borrow more to cover the loss in revenue, thus raising its interest payments and inflation. The Fed only works with the fiscal policy it is given: It isn’t Powell’s job to tell Trump or Republican congressional leaders to think again before adding $8 trillion to a national debt already dangerously approaching a level equal to economic output.

A Fed empowered to focus on its remit of keeping prices stable and employment full might be able to manage the effects of Trump’s agenda. The problem is that the president-elect has already shown his willingness to undermine the central bank’s hard-won independence. Few policymakers would welcome a return to the era of Chair Arthur Burns, who was pressured by President Richard Nixon to ease monetary policy, which left growth to stagnate and inflation to soar. “I respect his independence,” Nixon said of his friend. “However, I hope that, independently, he will conclude that my views are the ones that should be followed.”

It’s a sentiment shared by Trump, however, raising the specter that he might appoint a sycophant to lead the Fed or implement rules that limit its flexibility to interpret economic indicators. His aides have advised against firing Powell, who said on Thursday that he would not step down if asked to do so. That he was even asked about it is cause enough for concern, and only heightens the risk of stagflation.

Context News

The U.S. Federal Reserve’s Federal Open Market Committee on Nov. 7 unanimously voted to lower the benchmark overnight interest rate by 25 basis points, or a quarter percentage point, to a target range of 4.5%-4.75%. It is the FOMC’s second consecutive reduction in borrowing costs after it cut them by 50 basis points in September.

Updated 12:44 IST, November 8th 2024