Published 12:54 IST, January 17th 2024

RBI Governor highlights robust growth prospects for banking sector

Despite facing various shocks and crises, he noted that banking sector's impressive recovery, characterising it as one of its best periods in recent years.

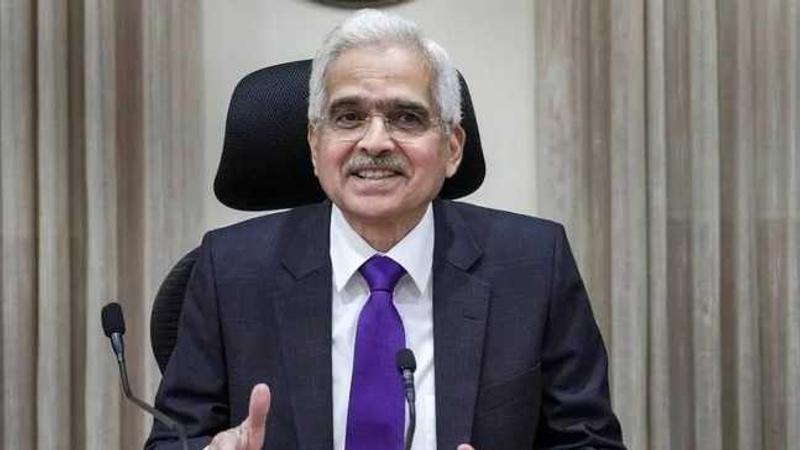

In a session at the annual meeting of the World Economic Forum, Reserve Bank of India (RBI) Governor Shaktikanta Das expressed optimism about India's growth prospects and underscored the remarkable recovery in the country's banking sector. Das stressed on international confidence in India and stability offered by its macroeconomic and financial sectors.

Das highlighted the opportune moment for businesses to invest in the Indian ecosystem, pointing to the favourable growth prospects driven by recent structural reforms. Despite facing various shocks and crises, he noted the Indian banking sector's impressive recovery, characterising it as one of its best periods in recent years.

He attributed India's positive momentum to ongoing structural changes and cited the regulatory architecture of both government and private sector banks and non-banking financial companies (NBFCs) as foundational elements supporting the belief in India's growth trajectory.

While acknowledging global challenges such as slowing growth and supply chain disruptions, Das highlighted India's proactive supervision and forward-looking approach in identifying and mitigating potential risks before they materialise. The National Statistical Office's projection of a 7.3 per cent growth for the Indian economy in 2023-24 further reflects the positive trajectory.

Addressing the query on cryptocurrency, Das expressed caution, labelling it as a highly speculative product with significant risks. He conveyed the RBI's careful stance, stressing the need for countries like India to exercise caution given the inherent risks associated with cryptocurrencies.

The RBI Governor's insights at the World Economic Forum underscored India's resilience and attractiveness for investment, backed by stable economic fundamentals and ongoing regulatory measures to ensure financial sector stability.

(With PTI inputs)

Updated 12:54 IST, January 17th 2024