Published 11:37 IST, August 7th 2024

Succession stakes in India Inc keep rising

Mukesh Ambani last year installed his three children to the board of his $230 billion oil-to-retail Reliance Industries.

Change of guard. India is preparing to hand the reins to a new generation of tycoons. Gautam Adani, 62, has laid out a plan for his four scions to jointly run his Adani Group when he retires from the infrastructure empire at 70. The family on Tuesday disputed details from Bloomberg's interview. Either way, it's a reminder that the stakes of corporate succession are rapidly rising in the world's fifth-largest economy.

Asian tycoons are increasingly speaking up on succession. Keen to avoid a repeat of the epic power struggle that erupted when his father died in 2002, Mukesh Ambani last year installed his three children to the board of his $230 billion oil-to-retail Reliance Industries with a pledge to mentor them while he sticks around as chairman and managing director for another five years.

The timing of Adani's disclosures is eye-catching, nonetheless. His group, comprised of some 10 listed companies, is keen to reduce any perception of a key-man risk around its chairman as it raises capital after a devastating short-seller attack. The outreach is paying off: Its energy transmission unit Adani Energy Solutions raised $1 billion on Monday from U.S.-based investors and sovereign funds. The flagship Adani Enterprises is preparing a share sale twice that size.

The retirement plan also underscores the family's long-term desire to retain a conglomerate status for the businesses, and the benefits that come with size. It's cheaper to borrow, for one. That's partly why the Tata companies are controlled by a common holding company, Tata Sons. It's unclear whether the Ambanis will strive for the same goal as the third generation take charge; Reliance is preparing to float its telecom and retail businesses.

Yet such structures also mean succession planning is a constant. The 86-year-old Ratan Tata, who led his family’s group for more than two decades until 2012, is setting the stage for a fifth-generation handover at the philanthropic trusts which control Tata Sons. His half-brother’s three children became trustees in an early sign of succession planning, the Times of India reported in May, citing unnamed sources.

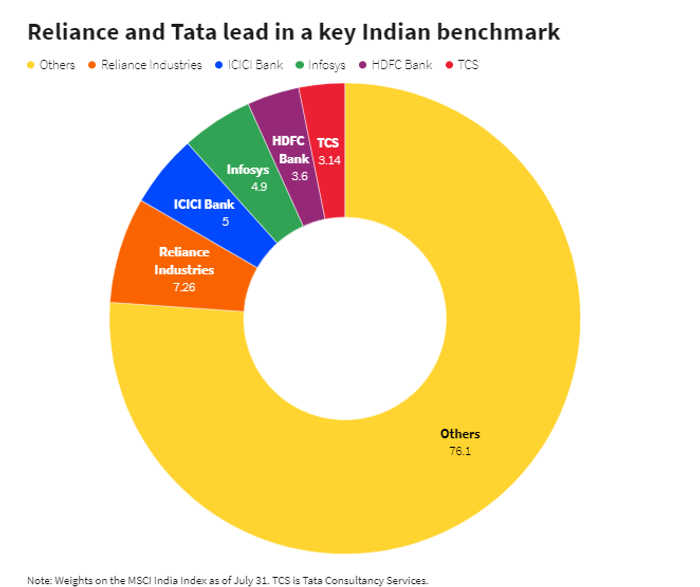

In sum, all three of India's top family businesses are staring at important transfers of power. The trio dominate every aspect of Indian life from salt to telecoms to airports. Their listed firms together make up 16% of the country’s $5.3 trillion market capitalisation, per Breakingviews calculations. Their planning needs to get sharper as global investors and companies from Apple to Shein to TotalEnergies increasingly look to tap growth opportunities in the $3.5 trillion economy in alliance with them. Adani's talk about succession is a reminder of what's at stake.

Updated 11:40 IST, August 7th 2024